Chairman of the Government

Russian Federation

D.Medvedev

Rules for calculating and collecting fees for negative environmental impact

APPROVED

Government resolution

Russian Federation

dated March 3, 2017 N 255

1. These Rules establish the procedure for calculating and collecting fees for negative impact on environment, as well as monitoring the correctness of its calculation, completeness and timeliness of its payment (hereinafter referred to as the fee, control over the calculation of the fee).

2. Fees are calculated and collected for the following types of negative impact on the environment:

a) emissions of pollutants into atmospheric air stationary sources (hereinafter referred to as emissions of pollutants);

b) discharges of pollutants into water bodies (hereinafter referred to as discharges of pollutants);

c) storage and burial of production and consumption waste (hereinafter referred to as waste disposal).

3. The specifics of calculating and collecting fees for emissions of pollutants during flaring and (or) dispersion of associated petroleum gas are established by Decree of the Government of the Russian Federation dated November 8, 2012 N 1148 “On the specifics of calculating fees for the negative impact on the environment during emissions into the atmospheric air of pollutants formed during combustion in flares and (or) dispersion of associated petroleum gas" (hereinafter referred to as Resolution No. 1148).

4. Control over the calculation of fees is carried out by the Federal Service for Supervision of Natural Resources and its territorial bodies (hereinafter also referred to as the fee administrator).

5. The fee is required to be paid by legal entities and individual entrepreneurs carrying out economic and (or) other activities that have a negative impact on the environment on the territory of the Russian Federation, the continental shelf of the Russian Federation and in the exclusive economic zone of the Russian Federation (hereinafter referred to as persons obliged to pay the fee ), with the exception of legal entities and individual entrepreneurs carrying out economic and (or) other activities exclusively at facilities that have a negative impact on the environment, category IV.

When disposing of waste, with the exception of solid municipal waste, the persons obligated to pay a fee are legal entities and individual entrepreneurs, during whose economic and (or) other activities the waste was generated.

When disposing of solid municipal waste, the persons obligated to pay a fee are regional operators for the management of solid municipal waste, operators for the management of municipal solid waste, carrying out activities for their disposal.

6. When placing waste at waste disposal sites that exclude a negative impact on the environment and are determined in accordance with the legislation of the Russian Federation in the field of waste management, no fee is charged for waste disposal.

7. The registration of persons obligated to pay a fee is carried out by the Federal Service for Supervision of Natural Resources when maintaining state records of objects that have a negative impact on the environment, in accordance with the Federal Law “On Environmental Protection”.

8. The fee is calculated by persons obligated to pay the fee independently by multiplying the value of the payment base for calculating the fee (hereinafter referred to as the payment base) for each pollutant included in the list of pollutants for which state regulatory measures in the field of environmental protection are applied, approved Decree of the Government of the Russian Federation dated July 8, 2015 N 1316-r (hereinafter referred to as the list of pollutants), according to the hazard class of production and consumption waste at the corresponding payment rates established by Decree of the Government of the Russian Federation dated September 13, 2016 N 913 "On rates fees for negative impact on the environment and additional coefficients" and Decree of the Government of the Russian Federation dated June 29, 2018 N 758 "On rates of payment for negative impact on the environment when disposing of solid municipal waste of hazard class IV (low-hazard) and amendments to some acts of the Government of the Russian Federation" (hereinafter referred to as Resolution No. 913, Resolution No. 758, payment rates), using the coefficients established by legislation in the field of environmental protection, as well as additional coefficients established by Resolution No. 913 and Resolution No. 1148, and summing up the received values (for each stationary source of environmental pollution (hereinafter referred to as the stationary source) and (or) waste disposal facility, by type of pollution and in general for the facility that has a negative impact on the environment, as well as their totality).

(Clause as amended, entered into force on July 11, 2018

9. The payment base is the volume or weight of emissions of pollutants, discharges of pollutants, or the volume or weight of waste disposed of in the reporting period.

The payment base is determined by persons obligated to pay the fee independently on the basis of production environmental control data:

a) for each stationary source actually used during the reporting period, in relation to each pollutant included in the list of pollutants;

b) in relation to each waste hazard class.

10. When determining the payment base, the following are taken into account:

a) the volume or mass of emissions of pollutants, discharges of pollutants within the limits of permissible emission standards, permissible discharge standards or technological standards;

.

b) the volume or mass of emissions of pollutants, discharges of pollutants within the limits of temporarily permitted emissions, temporarily permitted discharges of pollutants and microorganisms (hereinafter referred to as the limits on emissions and discharges);

(Subclause as amended, put into effect on January 1, 2019 by Decree of the Government of the Russian Federation dated March 3, 2017 N 255.

c) the volume or mass of emissions of pollutants, discharges of pollutants exceeding the standards specified in subparagraph "a" of this paragraph, emissions and discharges (including emergency) specified in subparagraph "b" of this paragraph;

(Subclause as amended, put into effect on January 1, 2019 by Decree of the Government of the Russian Federation dated March 3, 2017 N 255.

d) limits on the disposal of production and consumption waste and their exceeding.

11. Information on the payment base is submitted for the reporting period by persons obligated to pay the fee to the fee administrator as part of the declaration on the fee for negative impact on the environment (hereinafter referred to as the fee declaration), the procedure for submission and form of which are established by the Ministry natural resources and ecology of the Russian Federation.

11_1. When calculating fees by persons obligated to pay fees, carrying out economic and (or) other activities at facilities that have a negative impact on the environment, category III, the volume or mass of emissions of pollutants, discharges of pollutants, indicated in the report on the organization and on the results of implementation industrial environmental control are recognized as carried out within the limits of permissible emissions standards, permissible discharge standards, with the exception of radioactive substances, highly toxic substances, substances with carcinogenic, mutagenic properties (substances of I, II hazard classes).

Decree of the Government of the Russian Federation of March 3, 2017 N 255)

11_2. Persons obliged to pay fees who carry out economic and (or) other activities exclusively at facilities that have a negative impact, category III, in relation to the volume or mass of emissions of pollutants indicated in the reporting of emissions of harmful (pollutant) substances into the air (with the exception of emissions of radioactive substances), to calculate the fee, use the formula specified in paragraph 17 of these Rules, and in relation to emissions of pollutants exceeding the volume or mass of emissions of pollutants specified in the reporting of emissions of harmful (pollutant) substances into the atmospheric air, use the formula specified in paragraph 21 of these Rules.

If they fail to submit reports on emissions of harmful (pollutant) substances into the air, such persons use the formula specified in paragraph 21 of these Rules to calculate the fee.

(The paragraph was additionally included from January 1, 2019 by Decree of the Government of the Russian Federation dated March 3, 2017 N 255)

12. In the absence of valid permits for emissions of harmful (pollutant) substances into the atmospheric air, permits for discharges of pollutants (except for radioactive substances) and microorganisms into water bodies, documents approving standards for the generation of industrial and consumer waste and limits on their disposal, technological standards, comprehensive environmental permits containing standards for permissible impact on the environment, drawn up and issued in accordance with the procedure established by the legislation of the Russian Federation, persons obliged to pay a fee use the formulas specified in paragraphs 20 and 21 of these Rules to calculate the fee.

Decree of the Government of the Russian Federation of March 3, 2017 N 255.

13. Persons obliged to pay fees related to small and medium-sized businesses in relation to the volume or mass of production and consumption waste specified in the reporting on the generation, recycling, disposal, and disposal of waste, use the formula specified in paragraph 18 of these Rules. and in relation to waste exceeding the volume or weight of waste specified in the reporting on generation, recycling, neutralization, and waste disposal, use the formula specified in paragraph 20 of these Rules.

14. When determining the payment base by persons obligated to pay a fee in accordance with paragraph two of clause 5 of these Rules, the volumes or masses of overburden and host rocks, waste from the production of ferrous metals of hazard classes IV and V, used in the liquidation of mine workings in accordance with a project for their elimination in accordance with the legislation of the Russian Federation in the field of waste management, which are not included in the limits on waste disposal.

15. When discharging pollutants into water bodies, the payment base is determined by their volume or mass, which entered the water body as a result of the use of water, and is calculated as the difference between the volume or mass of pollutants contained in wastewater and the volume or the mass of these substances contained in water taken for use from the same water body.

16. For waste generated during the extraction of minerals, including during crushing, grinding, drying, sorting, cleaning and enrichment of ores (for uranium and thorium ores - during the primary enrichment of such ores), including leaching of metal ores, cleaning and enrichment of ores and sands of precious metals, cleaning and enrichment of coal, agglomeration of iron ores and solid fuels, when calculating fees for the disposal of production and consumption waste, the fee rates established by Resolution N 913 for waste of class V hazard (virtually non-hazardous) of the mining industry are applied.

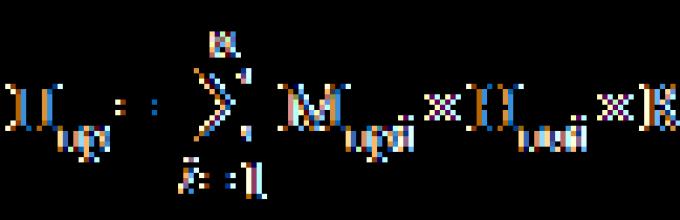

17. Payment within the limits (equal or less) of the standards for permissible emissions of pollutants or in accordance with the report on the organization and results of industrial environmental control, reporting on emissions of harmful (pollutant) substances into the air for objects that have a negative impact, category III or pollutant discharges () is calculated using the formula:

Decree of the Government of the Russian Federation of March 3, 2017 N 255.

Where:

- payment base for emissions or discharges of the i-th pollutant, determined by the person obliged to pay for the reporting period as the mass or volume of emissions of pollutants or discharges of pollutants in an amount equal to or less than the established standards for permissible emissions of pollutants or discharges of pollutants, ton (cubic m);

- rate of payment for the emission or discharge of the i-th pollutant in accordance with Resolution N 913

- an additional coefficient to the payment rates in relation to territories and objects under special protection in accordance with federal laws, equal to 2;

- coefficient to the rates of payment for the emission or discharge of the i-th pollutant for the volume or mass of emissions of pollutants, discharges of pollutants within the limits of permissible emission standards, permissible discharge standards, equal to 1;

n is the amount of pollutants.

18. Payment for waste disposal within the limits for waste disposal, as well as in accordance with reporting on the generation, recycling, neutralization and disposal of waste submitted by small and medium-sized businesses in accordance with the legislation of the Russian Federation in the field of waste management (), is calculated according to formula:

Where:

- payment base for the disposal of waste of the j-th hazard class, determined by the person obliged to pay for the reporting period as the mass or volume of disposed waste in an amount equal to or less than the established limits for waste disposal, ton (cub.m);

- the rate of payment for the disposal of waste of the jth hazard class in accordance with Resolution N 913, Resolution N 758, rubles/ton (rubles/cubic m);

(The paragraph as amended, put into effect on July 11, 2018 by Decree of the Government of the Russian Federation dated June 29, 2018 N 758, applies to legal relations that arose from January 1, 2018.

- coefficient to the rate of payment for the disposal of waste of the j-th hazard class for the volume or weight of production and consumption waste disposed within the limits for their placement, as well as in accordance with reporting on the generation, use, neutralization and disposal of production and consumption waste, submitted in accordance with the legislation of the Russian Federation in the field of waste management, equal to 1;

- incentive coefficient to the rate of payment for the disposal of waste of the j-th hazard class, adopted in accordance with paragraph 6 of Article 16_3 of the Federal Law “On Environmental Protection”;

m is the number of waste hazard classes.

19. Payment within the limits of temporarily permitted emissions, temporarily permitted discharges exceeding the standards of permissible emissions or discharges, technological standards (), is calculated using the formula:

(Paragraph as amended, put into effect on January 1, 2019 by Decree of the Government of the Russian Federation dated March 3, 2017 N 255.

Where:

- payment base for the emission or discharge of the i-th pollutant, determined by the person obliged to pay for the reporting period as the difference between the mass or volume of emissions of pollutants or discharges of pollutants in an amount equal to or less than the temporarily permitted emissions, temporarily permitted discharges, and the mass or volume of emissions of pollutants or discharges of pollutants within the established standards of permissible emissions (discharges), technological standards, ton (cub.m);

(Paragraph as amended, put into effect on January 1, 2019 by Decree of the Government of the Russian Federation dated March 3, 2017 N 255.

- coefficient for the rates of payment for the emission or discharge of the i-th pollutant for the volume or mass of emissions of pollutants, discharges of pollutants within the limits of established temporarily permitted emissions, temporarily permitted discharges of pollutants, equal to 5.

(Paragraph as amended, put into effect on January 1, 2019 by Decree of the Government of the Russian Federation dated March 3, 2017 N 255.

From January 1, 2020, by Decree of the Government of the Russian Federation dated March 3, 2017 N 255, changes will be made to paragraph five of clause 19.

____________________________________________________________________

20. Payment for the disposal of waste in excess of the established limits for its disposal or specified in the environmental impact statement, as well as when it is revealed that the actual values of disposed waste exceed those indicated in the reporting on the generation, recycling, neutralization and disposal of production and consumption waste, represented by small and medium-sized businesses in accordance with the legislation of the Russian Federation in the field of waste management (), is calculated using the formula:

(Paragraph as amended, put into effect on January 1, 2019 by Decree of the Government of the Russian Federation dated March 3, 2017 N 255.

Where:

- payment base for the disposal of waste of the j-th hazard class, determined by the person obliged to pay for the reporting period as the difference between the mass or volume of disposed waste and the mass or volume of the established limits for their disposal, ton (cub.m);

- coefficient to the rate of payment for the disposal of waste of the j-th hazard class for the volume or weight of waste disposed in excess of the established limits for their disposal or specified in the environmental impact statement, as well as in excess of the volume or weight of waste specified in the reporting education, use, neutralization and disposal of production and consumption waste, represented by small and medium-sized businesses in accordance with the legislation of the Russian Federation in the field of waste management, equal to 5.

(Paragraph as amended, put into effect on January 1, 2019 by Decree of the Government of the Russian Federation dated March 3, 2017 N 255.

____________________________________________________________________

From January 1, 2020, by Decree of the Government of the Russian Federation dated March 3, 2017 N 255, changes will be made to paragraph five of clause 20.

____________________________________________________________________

21. Payment in case of excess emissions of pollutants or discharges of pollutants established respectively in the comprehensive environmental permit, environmental impact declaration, as well as in the cases specified in paragraph 11_2 of these Rules (), is calculated according to the formula:

(Paragraph as amended, put into effect on January 1, 2019 by Decree of the Government of the Russian Federation dated March 3, 2017 N 255.

Where:

- payment base for the emission or discharge of the corresponding i-th pollutant, determined by the person obliged to pay for the reporting period as the difference between the mass or volume of emissions or discharges of pollutants in quantities exceeding the emissions or discharges of pollutants established in the relevant permits, and mass or volume of temporarily permitted emissions, temporarily permitted discharges, or in their absence, regulatory permissible emissions or discharges of pollutants, ton (cub.m);

(Paragraph as amended, put into effect on January 1, 2019 by Decree of the Government of the Russian Federation dated March 3, 2017 N 255.

- coefficient to the rates of payment for the emission or discharge of the corresponding i-th pollutant for the volume or mass of emissions of pollutants, discharges of pollutants exceeding those established by permits for emissions of pollutants into the atmosphere, permits for discharges of pollutants into the environment, equal to 25.

____________________________________________________________________

From January 1, 2020, by Decree of the Government of the Russian Federation of March 3, 2017 N 255, paragraph 21 will be stated in a new wording.

____________________________________________________________________

22. When calculating fees for the disposal of waste that is subject to accumulation and actually disposed of in its own production in accordance with technological regulations or transferred for disposal within a period not exceeding 11 months, provided for by the legislation of the Russian Federation in the field of waste management, the calculation is carried out according to the formula, specified in paragraph 20 of these Rules, in which, instead of coefficients, a coefficient is applied - for the volume or mass of waste subject to accumulation and used in its own production in accordance with technological regulations or transferred for use for a period not exceeding 11 months, provided for by the legislation of the Russian Federation in the field of waste management, equal to 0.

____________________________________________________________________

From January 1, 2020, by Decree of the Government of the Russian Federation dated March 3, 2017 N 255, these Rules will be supplemented with clause 22_1.

____________________________________________________________________

23. In case of failure to reduce the volume or mass of emissions of pollutants, discharges of pollutants within 6 months (in the case of construction treatment facilities for wastewater treatment - within 12 months) after the deadlines determined by the plans for reducing emissions and discharges established by Article 23 of the Federal Law "On Environmental Protection", calculated for the relevant reporting periods in which the fee was adjusted, the fee for emissions of pollutants , discharges of pollutants that exceed the standards for permissible emissions, standards for permissible discharges, are subject to recalculation without taking into account the deducted costs specified in paragraph 26 of these Rules, according to the formula specified in paragraph 21 of these Rules, and entered into the budgets of the budget system of the Russian Federation.

____________________________________________________________________

From January 1, 2020, by Decree of the Government of the Russian Federation of March 3, 2017 N 255, paragraph 23 will be stated in a new wording.

____________________________________________________________________

24. When calculating the fee, persons obliged to pay the fee have the right to independently adjust (reduce) its amount, except for the cases provided for in paragraph 23 of these Rules.

25. The costs of implementing measures to reduce the negative impact on the environment actually incurred by persons obligated to pay the fee are deducted from the amount of the fee, within the calculated fee for those indicators (each pollutant or hazard class of production and consumption waste for which the fee is calculated in terms of discharges and (or) emissions of pollutants, disposal of production and consumption waste), for which, in accordance with the environmental protection action plan or program for increasing environmental efficiency, it is envisaged to reduce discharges and (or) emissions of pollutants, increase utilization and disposal rates (disinfection) of production and consumption waste.

(Clause as amended, put into effect on January 1, 2019 by Decree of the Government of the Russian Federation dated March 3, 2017 N 255.

26. The costs of implementing measures to reduce the negative impact on the environment are recognized as documented expenses of persons obliged to pay fees in the reporting period to finance the activities provided for in paragraph 4 of Article 17 of the Federal Law "On Environmental Protection" and included in the plan of measures for protection environment or a program to improve environmental efficiency, as well as the costs of implementing measures to ensure the use and utilization of associated petroleum gas.

(Clause as amended, put into effect on January 1, 2019 by Decree of the Government of the Russian Federation dated March 3, 2017 N 255.

27. When adjusting the size of the fee, costs not specified in paragraph 26 of these Rules, including the costs of major repairs, are not taken into account.

28. The costs specified in paragraph 26 of these Rules and not taken into account when calculating fees in the reporting period may be taken into account in subsequent reporting periods during the period of implementation of the environmental action plan or environmental efficiency improvement program.

(Clause as amended, put into effect on January 1, 2019 by Decree of the Government of the Russian Federation dated March 3, 2017 N 255.

29. When adjusting the amount of the fee, the costs of implementing measures to reduce the negative impact on the environment and measures to ensure the use and utilization of associated petroleum gas, actually incurred by persons obliged to pay the fee, are confirmed by the following documents:

a) an environmental protection action plan or a program to improve environmental efficiency, a project for the beneficial use of associated petroleum gas and reports on the progress of their implementation;

(Subclause as amended, put into effect on January 1, 2019 by Decree of the Government of the Russian Federation dated March 3, 2017 N 255.

b) agreements with suppliers, contractors, performers for the supply of inventory, performance of work, provision of services, including the purchase of equipment, design, construction, reconstruction of facilities and structures, and payment documents drawn up in the prescribed manner, confirming the fact of payment for the equipment , work and other activities provided for by the environmental protection action plan or the environmental efficiency improvement program, the project for the beneficial use of associated petroleum gas, from the beginning of their implementation;

(Subclause as amended, put into effect on January 1, 2019 by Decree of the Government of the Russian Federation dated March 3, 2017 N 255.

c) documents confirming the provision of services, performance of work on the design, construction and reconstruction of objects and structures, including acts of acceptance and transfer of fixed assets and their commissioning, acts of acceptance of work (services) performed and certificates of the cost of work performed (services) and costs, invoices;

d) certified by the person obliged to pay the fee, explanatory note with a breakdown of the amounts of money spent on the implementation of measures to reduce the negative impact on the environment and measures to ensure the use and utilization of associated petroleum gas.

30. If the person obliged to pay the fee carried out an adjustment in its size during the reporting period or calculated the cost coverage indicator for the implementation of projects for the beneficial use of associated petroleum gas, information on the name and details (number, date) of the documents specified in paragraph 29 of these Rules (for each of the activities for which the amount of the fee was adjusted or the cost coverage indicator for the implementation of projects for the beneficial use of associated petroleum gas was calculated) is indicated in the declaration of the fee.

31. Payments for emissions of pollutants and discharges of pollutants are paid by persons obliged to pay the fee at the location of the stationary source. The fee for waste disposal is paid by persons obliged to pay the fee at the location of the production and consumption waste disposal facility.

32. The reporting period for fees is the calendar year.

The fee calculated based on the results of the reporting period, taking into account the adjustment of its amount, is paid no later than March 1 of the year following the reporting period.

33. Late or incomplete payment by the person obligated to pay the fee entails the payment of penalties in the amount of one three hundredth of the Bank of Russia key rate in effect on the day of payment of the penalties, but not more than 0.2 percent for each day of delay. The penalty is accrued for each calendar day of delay in fulfilling the obligation to pay the fee, starting from the next day after the end of the deadlines specified in paragraphs 32 and 34 of these Rules.

The end of the period for which penalties are accrued is the date of repayment by the person obligated to pay the payment of the debt in accordance with the payment order for the transfer of funds to the budgets of the budget system of the Russian Federation.

34. Persons obliged to pay fees, with the exception of small and medium-sized businesses, make quarterly advance payments (except for the fourth quarter) no later than the 20th day of the month following the last month of the corresponding quarter of the current reporting period, in the amount of one-fourth of the fee amount, paid for the previous year.

When making quarterly advance payments, a fee declaration is not required to be submitted to the fee administrator.

35. Persons obliged to pay a fee, no later than March 10 of the year following the reporting period, submit a declaration on the fee to the fee administrator at the place of registration of the facility that has a negative impact on the environment, the facility where production and consumption waste is disposed of.

36. The amount of overpaid (collected) fees shall be offset against future payments of the person obligated to pay the fee, or returned to the specified person. Offset and return of amounts of overpaid (collected) fees are carried out in the manner established by the Federal Service for Supervision of Natural Resources, on the basis of an application from the person obliged to pay the fee, no later than 3 months from the date of receipt by the Federal Service for Supervision of Natural Resources of the relevant application .

37. Control over the calculation of fees is carried out by the fee administrator within 9 months from the date of receipt of the declaration on the fee or during state environmental supervision in accordance with the Federal Law "On the protection of the rights of legal entities and individual entrepreneurs in the exercise of state control (supervision) and municipal control" .

38. The subject of control over the calculation of fees is the correctness of calculation, completeness and timeliness of payment, the obligation to pay which in accordance with the legislation in the field of environmental protection and these Rules is assigned to the person obliged to pay the fee.

Control over the calculation of fees is carried out through measures to verify the completeness and correctness of filling out the fee declaration and compliance with the deadlines for its submission (hereinafter referred to as verification of the fee declaration), and the timeliness of payment.

39. When checking the declaration of payment, it is established that the information and calculations submitted by the person obliged to pay the payment, as part of the declaration of payment and the documents attached to it, comply with the provisions of these Rules.

40. If, during an inspection of the fee declaration, errors are identified in this declaration and (or) contradictions between the information in the submitted documents, or inconsistencies are identified between the information provided by the person obligated to pay the fee and the information contained in the documents available to the fee administrator, and (or) received by him in the course of monitoring the calculation of the fee, the person obliged to pay the fee is informed about this, with the requirement to provide the necessary justified explanations within 7 working days (with additional documents attached, if necessary) and (or) to make appropriate corrections to set deadline.

41. In case of disagreement with the facts set out in the requirement specified in paragraph 40 of these Rules, the person obliged to pay the fee has the right to submit written objections to the fee administrator regarding the specified requirement as a whole or on its individual provisions. In this case, the person obliged to pay the fee has the right to attach to written objections or, within the agreed period, transfer to the fee administrator documents (their certified copies) confirming the validity of his objections.

42. In the case specified in paragraph 40 of these Rules, the fee administrator has the right to request from the person obliged to pay the fee, who has adjusted its amount during the reporting period, certified copies of the documents specified in paragraph 29 of these Rules. Within 7 working days from the date of receipt of the corresponding request from the fee administrator, the person obliged to pay the fee is obliged to send copies of the documents specified in the request to the fee administrator.

Copies of documents requested in accordance with paragraph one of this paragraph may be sent to the board administrator in the form electronic document, signed with an electronic signature in accordance with the requirements of the Federal Law “On Electronic Signatures”.

43. Absence in the declaration of payment submitted by the person obligated to pay the fee, who in the reporting period adjusted the amount of the fee or calculated the cost coverage indicator for the implementation of projects for the beneficial use of associated petroleum gas, information specified in paragraph 30 of these Rules, as well as failure to provide ( submission by such person of copies of documents specified in paragraph 29 of these Rules incompletely, within the period established in paragraph 42 of these Rules, is the basis for the administrator to issue a fee to the person obligated to pay the fee, a requirement for its additional accrual and addition to the budgets of the budget system Russian Federation.

44. When conducting an audit of the fee declaration, it is mandatory to consider the explanations and additional documents submitted by the person obligated to pay the fee.

If, after considering the explanations of the person obligated to pay the fee and submitting additional documents, or if the person obligated to pay the fee fails to comply with the requirement to provide explanations or fails to make appropriate corrections within the prescribed period, the fee administrator determines the presence of errors in the fee declaration and (or) contradictions between the information in the submitted documents, his authorized officials draw up an act of control over the calculation of fees in the manner and form established by the Federal Service for Supervision of Natural Resources.

An act of control over the calculation of fees is drawn up within 20 working days from the date of submission by the person obliged to pay the fee, explanations and additional documents, in case of failure to comply with the requirements for the submission of explanations and additional documents - within 20 working days from the date of expiration of the deadlines established by such requirements .

45. The act of monitoring the calculation of fees shall indicate:

a) the date of drawing up the act of monitoring the calculation of fees;

b) full and abbreviated name of the legal entity (separate division) or last name, first name, patronymic (if any) of an individual entrepreneur, address of location or place of residence;

c) last name, first name, patronymic (if any) of the person exercising control over the calculation of fees, his position, name of the fee administrator;

d) date of submission of the declaration of payment and other documents;

e) a list of documents submitted by the inspected person during the control over the calculation of fees;

f) the period for which control over the calculation of fees was carried out;

g) the name of the types of fees in respect of which control over the calculation of fees was carried out;

h) information on control measures carried out during control over the calculation of fees;

i) documented facts of errors when performing calculations and inconsistencies (contradictions) between the information presented in the documents used during the control;

j) conclusions and proposals for eliminating identified errors in calculations and inconsistencies (contradictions) in documents.

46. In case of detection of an underestimated amount of the calculated and (or) paid actual fee and (or) the need to pay penalties, the relevant information is included in the act of monitoring the calculation of the fee and the fee administrator issues a requirement to the person obliged to pay the fee to contribute to the budgets of the budget system Russian Federation additional fees and penalties.

47. If the person obligated to pay the fee fails to fulfill the requirement specified in paragraph 46 of these Rules within 10 calendar days, the fee administrator begins the procedure for collecting the fee in court.

48. If an overestimated amount of the calculated and (or) paid actual fee is detected, the relevant information is included in the act of monitoring the calculation of the fee and the fee administrator invites the person obliged to pay the fee to formalize in the prescribed manner an offset of the overpayment against the future reporting period.

A person obligated to pay a fee, in case of disagreement with the proposal set out in the act of monitoring the calculation of the fee, to set off the fee, has the right to send to the fee administrator an application for the return in the prescribed manner of the amount of the overpaid fee.

Decisions on offset (refund) of overpaid fees are made by the Federal Service for Supervision of Natural Resources in the manner established by the budget legislation of the Russian Federation.

49. If, during an inspection of the declaration of payment, measures to verify the timeliness of payment of the payment, it is revealed that the person obliged to pay the payment, within 9 months after the expiration of the period established by paragraph 35 of these Rules, did not submit a declaration of payment for the reporting period and (or) the previous 2 years, the fee administrator sends the specified person a request to contribute the fee amounts to the budgets of the budget system of the Russian Federation, as well as penalties accrued in accordance with paragraph 33 of these Rules.

A person obliged to pay a fee has the right to submit a declaration of payment based on factual data and supporting documents no later than 15 calendar days from the date of receipt of the request specified in paragraph one of this paragraph. After the expiration of the specified period, the fee administrator, in accordance with the legislation of the Russian Federation, begins the procedure for collecting fees and penalties in court.

50. Receipt by the fee administrator of information about the payment of quarterly advance payments by the person obligated to pay the fee is ensured as part of the execution of relevant agreements on interaction with territorial bodies of the Federal Treasury.

51. Forms, formats, procedures for filling out and submitting documents on paper or in the form of an electronic document used when conducting and processing the results of control over the calculation of fees, organizing interaction between the person obliged to pay the fee and the fee administrator are approved by the Federal Service for Supervision of Natural Resources in agreement with the Ministry of Natural Resources and Environment of the Russian Federation.

52. In case of failure to pay or incomplete payment of the fee within the established period, the fee administrator applies administrative sanctions provided for by the legislation on administrative offenses in relation to persons obliged to pay the fee, carrying out economic and (or) other activities at facilities subject to federal state environmental supervision, and sends them to authorized bodies executive branch subjects of the Russian Federation information about these persons.

Executive authorities of the constituent entities of the Russian Federation apply administrative sanctions provided for by the legislation on administrative offenses in relation to persons obliged to pay fees, carrying out economic and (or) other activities at facilities subject to regional state environmental supervision.

53. If the person obligated to pay the fee does not voluntarily repay the arrears of the fee, the fee administrator shall collect the fee and penalties on it in court.

Changes to the Rules for Calculating and Collection of Fees for Negative Impact on the Environment

APPROVED

Government resolution

Russian Federation

dated March 3, 2017 N 255

1. In paragraph 10:

a) subparagraph “a” should be supplemented with the words “or technological standards”;

b) in subparagraph "b"

c) in subparagraph "c" the words "limits (including emergency emissions and discharges)" shall be replaced with the words "emissions and discharges (including emergency)".

2. Add paragraphs 11_1 and 11_2 with the following content:

"11_1. When calculating fees by persons obliged to pay fees, carrying out economic and (or) other activities at facilities that have a negative impact on the environment, category III, the volume or mass of emissions of pollutants, discharges of pollutants, specified in the report on the organization and on the results of industrial environmental control are recognized as carried out within the limits of permissible emissions standards, permissible discharge standards, with the exception of radioactive substances, highly toxic substances, substances with carcinogenic, mutagenic properties (substances of hazard classes I and II).

11_2. Persons obliged to pay fees who carry out economic and (or) other activities exclusively at facilities that have a negative impact, category III, in relation to the volume or mass of emissions of pollutants indicated in the reporting of emissions of harmful (pollutant) substances into the air (with the exception of emissions of radioactive substances), to calculate the fee, use the formula specified in paragraph 17 of these Rules, and in relation to emissions of pollutants exceeding the volume or mass of emissions of pollutants specified in the reporting of emissions of harmful (pollutant) substances into the atmospheric air, use the formula specified in paragraph 21 of these Rules.

If they fail to submit reports on emissions of harmful (pollutant) substances into the air, such persons use the formula specified in paragraph 21 of these Rules to calculate the fee."

3. Clause 12 after the words “and limits on their placement,” add the words “technological standards, comprehensive environmental permits,”;

4. Paragraph one of paragraph 17 after the words “pollutants” is supplemented with the words “or in accordance with the report on the organization and results of industrial environmental control, reporting on emissions of harmful (pollutant) substances into the air for objects that have a negative impact, category III ".

5. In paragraph 19:

a) in the first paragraph:

the words “limits on emissions and discharges” shall be replaced with the words “temporarily permitted emissions, temporarily permitted discharges”;

after the words “permissible emissions or discharges” add the words “technological standards”;

b) in paragraph four:

the words “limits on emissions and discharges” shall be replaced with the words “temporarily permitted emissions, temporarily permitted discharges”;

after the words “permissible emissions (discharges),” add the words “technological standards”;

c) in paragraph five:

the words “limits on emissions and discharges for the period of implementation of the plan to reduce emissions and discharges” shall be replaced with the words “temporarily permitted emissions, temporarily permitted discharges of pollutants”;

6. In paragraph 20:

the first paragraph after the words “their placement” should be supplemented with the words “or specified in the environmental impact statement”;

in paragraph five:

after the words “their placement” add the words “or specified in the environmental impact statement”;

replace the number "5" with the numbers "25".

7. In paragraph 21:

in paragraph one, the words “permits for emissions of pollutants into the atmosphere and discharges of pollutants into the environment” should be replaced with the words “comprehensive environmental permit, declaration of environmental impact, as well as in the cases specified in paragraph 11_2 of these Rules”;

in paragraph four, the words “limits on emissions and discharges” should be replaced with the words “temporarily permitted emissions, temporarily permitted discharges.”

8. Point 21

"21. Payment in case of excess of emissions or discharges of pollutants established by a comprehensive environmental permit for objects of category I, as well as in case of excess of emissions or discharges of pollutants specified in the declaration of environmental impact for objects of category II (), is calculated according to the formula:

Where:

- payment base for the emission or discharge of the corresponding i-th pollutant, determined by the person obliged to pay for the reporting period as the difference between the mass or volume of emissions of pollutants or discharges of pollutants in excess of their quantity established by the complex permit for objects of category I or specified in the environmental impact statement for category II facilities, and the mass of pollutant emissions or discharges of pollutants determined by the specified documents, ton (cub.m);

- coefficient to the rates of payment for the emission or discharge of the corresponding i-th pollutant for the volume or mass of emissions of pollutants, discharges of pollutants exceeding the volume or mass established for objects of category I, as well as exceeding those specified in the environmental impact declaration for objects Category II is a volume or mass equal to 100."

9. Add clause 22_1 with the following content:

"22_1. When calculating fees for emissions or discharges of pollutants within limits equal to technological standards or less than technological standards after the introduction of the best available technologies at a facility that has a negative impact on the environment, the calculation is carried out according to the formula specified in paragraph 17 of these Rules, in in which, instead of a coefficient, a coefficient is applied - for the volume or mass of emissions of pollutants, discharges of pollutants within the limits of technological standards after the implementation of the best available technologies at a facility that has a negative impact on the environment, equal to 0."

10. Clause 23 should be stated as follows:

"23. In case of non-compliance with the reduction of emissions of pollutants, discharges of pollutants within 6 months after the deadlines determined by the environmental action plan or the environmental efficiency improvement program, calculated for the relevant reporting periods in which the fee was adjusted, the emission fee pollutants, discharges of pollutants that exceed permissible emission standards, permissible discharge standards or technological standards are subject to recalculation without taking into account the deducted costs specified in paragraph 26 of these Rules, according to the formula specified in paragraph 21 of these Rules, and entered into the budgets of the budget system of the Russian Federation."

11. Clause 25 should be stated as follows:

"25. The costs of implementing measures to reduce the negative impact on the environment, actually incurred by persons obligated to pay the fee, are deducted from the amount of the fee, within the calculated fee for those indicators (each pollutant or hazard class of production and consumption waste for which the calculation is made fees in terms of discharges and (or) emissions of pollutants, disposal of production and consumption waste), for which, in accordance with the environmental action plan or program for increasing environmental efficiency, it is envisaged to reduce discharges and (or) emissions of pollutants, increase indicators of use and neutralization (disinfection) of production and consumption waste."

1. Decree of the Government of the Russian Federation of August 28, 1992 N 632 “On approval of the Procedure for determining fees and their maximum amounts for environmental pollution, waste disposal, and other types of harmful effects” (Collected Acts of the President and Government of the Russian Federation, 1992, N 10, art. 726).

2. Clause 23 of the amendments and additions that are made to the decisions of the Government of the Russian Federation in connection with the adoption of the Constitution of the Russian Federation, approved by Decree of the Government of the Russian Federation of December 27, 1994 N 1428 “On amendments and invalidation of decisions of the Government of the Russian Federation in connection with adoption of the Constitution of the Russian Federation" (Collection of Legislation of the Russian Federation, 1995, No. 3, Art. 190).

3. Decree of the Government of the Russian Federation of June 14, 2001 N 463 “On invalidating the first paragraph of paragraph 9 of the Procedure for determining fees and their maximum amounts for environmental pollution natural environment, waste disposal, other types of harmful effects approved by Decree of the Government of the Russian Federation of August 28, 1992 N 632" (Collected Legislation of the Russian Federation, 2001, N 26, Art. 2678).

4. Decree of the Government of the Russian Federation of March 6, 2012 N 192 “On introducing amendments to the Decree of the Government of the Russian Federation of August 28, 1992 N 632” (Collected Legislation of the Russian Federation, 2012, N 11, Art. 1309).

5. Decree of the Government of the Russian Federation of April 17, 2013 N 347 “On approval of the Rules for reducing fees for negative impacts on the environment in the event that organizations engaged in wastewater disposal, subscribers of such organizations carry out environmental protection measures” (Collection of Legislation of the Russian Federation, 2013, N 16, art. 1974).

6. Clause 1 of the changes that are being made to the acts of the Government of the Russian Federation, approved by Decree of the Government of the Russian Federation dated April 30, 2013 N 393 “On approval of the Rules for establishing for subscribers of organizations engaged in wastewater disposal, standards for permissible discharges of pollutants, other substances and microorganisms in water bodies through centralized systems water disposal and limits on discharges of pollutants, other substances and microorganisms and on amendments to certain acts of the Government of the Russian Federation" (Collected Legislation of the Russian Federation, 2013, No. 20, Art. 2489).

7. Decree of the Government of the Russian Federation of December 26, 2013 N 1273 “On amendments to certain acts of the Government of the Russian Federation” (Collected Legislation of the Russian Federation, 2014, N 2, Art. 100).

Revision of the document taking into account

changes and additions prepared

JSC "Kodeks"

GOVERNMENT OF THE RUSSIAN FEDERATION

ABOUT CALCULATION AND COLLECTION

FEES FOR NEGATIVE IMPACT ON THE ENVIRONMENT

In accordance with Articles 16.3 and 16.5 of the Federal Law “On Environmental Protection”, the Government of the Russian Federation decides:

1. Approve the attached:

Rules for calculating and collecting fees for negative environmental impact;

changes that are being made to the Rules for calculating and collecting fees for negative impacts on the environment, approved by Decree of the Government of the Russian Federation dated March 3, 2017 N 255 “On the calculation and collection of fees for negative impacts on the environment.”

2. Recognize as invalid the decisions of the Government of the Russian Federation on the list according to the appendix.

3. Establish that:

The rules approved by this resolution apply to legal relations that arose from January 1, 2016;

paragraphs 1 - 4, paragraph 5 with the exception of paragraph ten, paragraph 6 with the exception of paragraph five, paragraph 7, paragraphs 11 - 12 of the changes approved by this resolution come into force on January 1, 2019;

paragraph ten of paragraph 5, paragraph five of paragraph 6, paragraphs 8 - 10 of the changes approved by this resolution come into force on January 1, 2020.

Chairman of the Government

Russian Federation

D.MEDVEDEV

Approved

Government resolution

Russian Federation

dated March 3, 2017 N 255

RULES

CALCULATIONS AND CHARGES FOR NEGATIVE IMPACT

ON THE ENVIRONMENT ( cm. in SPS "Consultant Plus")

CHANGES,

WHICH ARE INTRODUCED TO THE RULES FOR CALCULATION AND COLLECTION OF FEE

FOR NEGATIVE IMPACT ON THE ENVIRONMENT ( cm. in SPS "Consultant Plus")

Application

to the Government resolution

Russian Federation

dated March 3, 2017 N 255

SCROLL

REVOKED DECISIONS OF THE GOVERNMENT OF THE RUSSIAN FEDERATION

1. Decree of the Government of the Russian Federation of August 28, 1992 N 632 “On approval of the Procedure for determining fees and their maximum amounts for environmental pollution, waste disposal, and other types of harmful effects” (Collected Acts of the President and Government of the Russian Federation, 1992, N 10, art. 726).

2. Clause 23 of the changes and additions that are made to the decisions of the Government of the Russian Federation in connection with the adoption of the Constitution of the Russian Federation, approved by Decree of the Government of the Russian Federation of December 27, 1994 N 1428 “On amendments and invalidation of decisions of the Government of the Russian Federation in connection with adoption of the Constitution of the Russian Federation" (Collection of Legislation of the Russian Federation, 1995, No. 3, Art. 190).

3. Decree of the Government of the Russian Federation dated June 14, 2001 N 463 “On invalidating the first paragraph of clause 9 of the Procedure for determining the fee and its maximum amounts for environmental pollution, waste disposal, and other types of harmful effects, approved by the Decree of the Government of the Russian Federation dated August 28, 1992 N 632" (Collection of Legislation of the Russian Federation, 2001, N 26, Art. 2678).

4. Decree of the Government of the Russian Federation of March 6, 2012 N 192 “On introducing amendments to the Decree of the Government of the Russian Federation of August 28, 1992 N 632” (Collected Legislation of the Russian Federation, 2012, N 11, Art. 1309).

5. Decree of the Government of the Russian Federation of April 17, 2013 N 347 “On approval of the Rules for reducing fees for negative impacts on the environment in the event of environmental protection measures being carried out by organizations engaged in wastewater disposal, subscribers of such organizations” (Collected Legislation of the Russian Federation, 2013, N 16, art. 1974).

6. Clause 1 of the changes that are being made to the acts of the Government of the Russian Federation, approved by Decree of the Government of the Russian Federation dated April 30, 2013 N 393 “On approval of the Rules for establishing for subscribers of organizations engaged in wastewater disposal, standards for permissible discharges of pollutants, other substances and microorganisms in water bodies through centralized drainage systems and limits on discharges of pollutants, other substances and microorganisms and on amendments to certain acts of the Government of the Russian Federation" (Collected Legislation of the Russian Federation, 2013, No. 20, Art. 2489).

7. Decree of the Government of the Russian Federation of December 26, 2013 N 1273 “On amendments to certain acts of the Government of the Russian Federation” (Collected Legislation of the Russian Federation, 2014, N 2, Art. 100).

1. These Rules establish the procedure for calculating and collecting fees for negative impacts on the environment, as well as monitoring the correctness of its calculation, completeness and timeliness of its payment (hereinafter referred to as fees, control over the calculation of fees).

2. Fees are calculated and collected for the following types of negative impact on the environment:

a) emissions of pollutants into the atmospheric air from stationary sources (hereinafter referred to as emissions of pollutants);

b) discharges of pollutants into water bodies (hereinafter referred to as discharges of pollutants);

c) storage and burial of production and consumption waste (hereinafter referred to as waste disposal).

3. The specifics of calculating and collecting fees for emissions of pollutants during flaring and (or) dispersion of associated petroleum gas are established by Decree of the Government of the Russian Federation dated November 8, 2012 No. 1148 “On the specifics of calculating fees for the negative impact on the environment during emissions into the atmospheric air of pollutants generated during flaring and (or) dispersion of associated petroleum gas" (hereinafter referred to as Resolution No. 1148).

4. Control over the calculation of fees is carried out by the Federal Service for Supervision of Natural Resources and its territorial bodies (hereinafter also referred to as the fee administrator).

5. The fee is required to be paid by legal entities and individual entrepreneurs carrying out economic and (or) other activities that have a negative impact on the environment on the territory of the Russian Federation, the continental shelf of the Russian Federation and in the exclusive economic zone of the Russian Federation (hereinafter referred to as persons obliged to pay the fee ), with the exception of legal entities and individual entrepreneurs carrying out economic and (or) other activities exclusively at facilities that have a negative impact on the environment, category IV.

When disposing of waste, with the exception of solid municipal waste, the persons obligated to pay a fee are legal entities and individual entrepreneurs, during whose economic and (or) other activities the waste was generated.

When disposing of solid municipal waste, the persons obligated to pay a fee are regional operators for the management of solid municipal waste, operators for the management of municipal solid waste, carrying out activities for their disposal.

6. When placing waste at waste disposal sites that exclude a negative impact on the environment and are determined in accordance with the legislation of the Russian Federation in the field of waste management, no fee is charged for waste disposal.

7. Registration of persons obligated to pay a fee is carried out by the Federal Service for Supervision of Natural Resources when maintaining state records of objects that have a negative impact on the environment, in accordance with Federal law"On environmental protection".

8. The fee is calculated by persons obligated to pay the fee independently by multiplying the value of the payment base for calculating the fee (hereinafter referred to as the payment base) for each pollutant included in the list of pollutants for which state regulatory measures in the field of environmental protection are applied, approved Decree of the Government of the Russian Federation dated July 8, 2015 No. 1316-r (hereinafter referred to as the list of pollutants), according to the hazard class of production and consumption waste at the corresponding payment rates established by Decree of the Government of the Russian Federation dated September 13, 2016 No. 913 “On rates fees for negative impact on the environment and additional coefficients" (hereinafter referred to as Resolution No. 913, fee rates), using the coefficients established by legislation in the field of environmental protection, as well as additional coefficients established by Resolution No. 913 and Resolution No. 1148, and summing up the obtained values (for each stationary source of environmental pollution (hereinafter referred to as the stationary source) and (or) waste disposal facility, by type of pollution and in general for the facility that has a negative impact on the environment, as well as their totality).

9. The payment base is the volume or weight of emissions of pollutants, discharges of pollutants, or the volume or weight of waste disposed of in the reporting period.

The payment base is determined by persons obligated to pay the fee independently on the basis of production environmental control data:

a) for each stationary source actually used during the reporting period, in relation to each pollutant included in the list of pollutants;

b) in relation to each waste hazard class.

10. When determining the payment base, the following are taken into account:

after the words “permissible emissions or discharges” add the words “technological standards”;

the words “limits on emissions and discharges” shall be replaced with the words “temporarily permitted emissions, temporarily permitted discharges”;

after the words “permissible emissions (discharges),” add the words “technological standards”;

the words “limits on emissions and discharges for the period of implementation of the plan to reduce emissions and discharges” shall be replaced with the words “temporarily permitted emissions, temporarily permitted discharges of pollutants”;

after the words “their placement” add the words “or specified in the environmental impact statement”;

replace the number "5" with the numbers "25".

in the words “permits for emissions of pollutants into the atmospheric air and discharges of pollutants into the environment”, replace them with the words “comprehensive environmental permit, declaration of environmental impact, as well as in the cases specified in these Rules”;

in the words “limits on emissions and discharges”, replace them with the words “temporarily permitted emissions, temporarily permitted discharges”.

8. stated as follows:

"21. Payment in case of excess of emissions or discharges of pollutants established by a comprehensive environmental permit for objects of category I, as well as in case of excess of emissions or discharges of pollutants specified in the declaration of environmental impact for objects of category II, is calculated according to the formula:

![]() ,

,

The payment base for the emission or discharge of the corresponding i-th pollutant, determined by the person obliged to pay for the reporting period as the difference between the mass or volume of emissions of pollutants or discharges of pollutants in excess of their quantity established by the complex permit for objects of category I or specified in the declaration of environmental impact for objects of category II, and the mass of emissions of pollutants or discharges of pollutants determined by the specified documents, ton (cub. m);

Coefficient to the rates of payment for the emission or discharge of the corresponding i-th pollutant for the volume or mass of emissions of pollutants, discharges of pollutants exceeding the volume or mass established for objects of category I, and also exceeding those specified in the environmental impact statement for objects of II categories are volume or mass equal to 100."

9. Add clause 22.1 with the following content:

"22.1. When calculating fees for emissions or discharges of pollutants within limits equal to technological standards or less than technological standards after the introduction of the best available technologies at a facility that has a negative impact on the environment, the calculation is carried out according to the formula specified in these Rules, in which instead of coefficient is applied - for the volume or mass of emissions of pollutants, discharges of pollutants within the limits of technological standards after the introduction of the best available technologies at a facility that has a negative impact on the environment, equal to 0."

10. stated as follows:

"23. In case of non-compliance with the reduction of emissions of pollutants, discharges of pollutants within 6 months after the deadlines determined by the environmental action plan or the environmental efficiency improvement program, calculated for the relevant reporting periods in which the fee was adjusted, the emission fee pollutants, discharges of pollutants that exceed permissible emission standards, permissible discharge standards or technological standards are subject to recalculation without taking into account the deducted costs specified in these Rules, according to the formula specified in these Rules, and entered into the budgets of the budget system of the Russian Federation."

11. stated as follows:

"25. The costs of implementing measures to reduce the negative impact on the environment, actually incurred by persons obligated to pay the fee, are deducted from the amount of the fee, within the calculated fee for those indicators (each pollutant or hazard class of production and consumption waste for which the calculation is made fees in terms of discharges and (or) emissions of pollutants, disposal of production and consumption waste), for which, in accordance with the environmental action plan or program for increasing environmental efficiency, it is envisaged to reduce discharges and (or) emissions of pollutants, increase indicators of use and neutralization (disinfection) of production and consumption waste."

12. In , and and the words “plans for reducing emissions and discharges” in the appropriate case are replaced with the words “an environmental protection action plan or a program for increasing environmental efficiency” in the appropriate case.

Scroll

decisions of the Government of the Russian Federation that have become invalid

1. Decree of the Government of the Russian Federation of August 28, 1992 No. 632 “On approval of the Procedure for determining fees and their maximum amounts for environmental pollution, waste disposal, and other types of harmful effects” (Collected Acts of the President and Government of the Russian Federation, 1992, No. 10, art. 726).

2. Clause 23 of the changes and additions that are made to the decisions of the Government of the Russian Federation in connection with the adoption of the Constitution of the Russian Federation, approved by Decree of the Government of the Russian Federation of December 27, 1994 No. 1428 “On amendments and invalidation of decisions of the Government of the Russian Federation in connection with adoption of the Constitution of the Russian Federation" (Collection of Legislation of the Russian Federation, 1995, No. 3, Art. 190).

3. Decree of the Government of the Russian Federation dated June 14, 2001 No. 463 “On invalidating the first paragraph of clause 9 of the Procedure for determining fees and their maximum amounts for environmental pollution, waste disposal, and other types of harmful effects, approved by the Decree of the Government of the Russian Federation dated August 28, 1992 No. 632" (Collection of Legislation of the Russian Federation, 2001, No. 26, Art. 2678).

4. Decree of the Government of the Russian Federation of March 6, 2012 No. 192 “On introducing amendments to Decree of the Government of the Russian Federation of August 28, 1992 No. 632” (Collected Legislation of the Russian Federation, 2012, No. 11, Art. 1309).

5. Decree of the Government of the Russian Federation of April 17, 2013 No. 347 “On approval of the Rules for reducing fees for negative impacts on the environment in the event that organizations engaged in wastewater disposal, subscribers of such organizations carry out environmental protection measures” (Collected Legislation of the Russian Federation, 2013, No. 16, art. 1974).

6. Clause 1 of the changes that are being made to the acts of the Government of the Russian Federation, approved by Decree of the Government of the Russian Federation dated April 30, 2013 No. 393 “On approval of the Rules for establishing for subscribers of organizations engaged in wastewater disposal, standards for permissible discharges of pollutants, other substances and microorganisms in water bodies through centralized drainage systems and limits on discharges of pollutants, other substances and microorganisms and on amendments to certain acts of the Government of the Russian Federation" (Collected Legislation of the Russian Federation, 2013, No. 20, Art. 2489).

7. Decree of the Government of the Russian Federation of December 26, 2013 No. 1273 “On amendments to certain acts of the Government of the Russian Federation” (Collected Legislation of the Russian Federation, 2014, No. 2, Art. 100).

Document overview

Rules have been established for calculating and collecting fees for negative impacts on the environment.

The types of negative impacts for which fees are charged have been determined. These are emissions of pollutants into the air from stationary sources, discharges of pollutants into water bodies, and waste disposal.

Legal entities and individual entrepreneurs engaged in economic or other activities on the territory of Russia, the continental shelf and in the exclusive economic zone of Russia are required to pay a fee if this activity has a negative impact on the environment. An exception is made for entities carrying out activities only at facilities that have minimal negative impact on the environment (category IV facilities).

Payment for the disposal of waste (except for municipal solid waste) is paid by the legal entity and individual entrepreneur during whose activities the waste was generated. Payments for the disposal of municipal solid waste are paid by the regional operators (operators) for the management of municipal solid waste involved in their disposal.

To encourage business entities to reduce their negative impact on the environment and implement the best available technologies, it is envisaged to apply incentive coefficients to payment rates. Also, the actual costs incurred for measures to reduce the negative impact on the environment are deducted from the fee amount.

Control over the calculation of fees is entrusted to Rosprirodnadzor.